Forecasting is the alpha and omega of the software industry—the one question everybody asks daily: “What’s your forecast for the quarter?!” Despite its importance in building accurate revenue projections, sales forecasting often falls short due to one structural bias: Salespeople, by nature, tend to be overly optimistic. They create deals too early, fail to kill deals even when they’re already dead, and assume they’re going to win everything.

The key to produce an accurate sales forecast in B2B Tech / B2B SaaS lies in moving away from subjective, activity-based forecasting and adopting a structured, data-driven process that is repeatable and scalable across the organization.

Exec Summary

In this article about accurate sales forecast in B2B Tech / B2B SaaS, we will share how to:

- Move away from activity-based forecasting and lack of data analysis so that you don’t create biased forecasts.

- Implement the three foundational pillars of reliable sales forecasting: aligning forecasts with customer decision process, accounting for intra-quarter pipeline creation, and closing the loop by comparing forecasts with actuals.

- Empower your sales teams with a forecasting playbook that defines precisely processes, rules and criteria to apply when forecasting a deal.

Why Sales Forecasting Is (Often) Biased

Basic B2B Tech / B2B SaaS sales forecasting methods, while common, are inherently flawed and unreliable for several reasons.

1. Sales Rep. Subjectivity Creates Inconsistency

Sales forecasting based on individual reps’ evaluations of deal progress is inherently flawed due to the subjective nature of human judgment. Optimism, self-interest, limited experience, or fear of missing quotas can color their assessments. Optimistic sales reps may overestimate the likelihood of closing deals, while pessimistic reps might underplay opportunities, leading to skewed forecasts.

This subjectivity creates inconsistency, making it difficult to aggregate reliable numbers across teams and reps. Moreover, when managers adjust forecasts, it introduces a second layer of bias, often influenced by their own perceptions or pressure to meet targets.

2. Get Rid of Activity-Based Sales Forecasting

Forecasting based on internal activities prioritizes what the sales team is doing rather than focusing on how the customer is progressing in their decision-making process. While it’s easier to rely on metrics like the number of meetings held, proposals sent, or demos completed, these activities don’t necessarily indicate the customer’s readiness to buy.

For example, a demo may occur without key decision-makers present, or a proposal may be sent before the customer has finalized their budget. Without aligning forecasts with customer milestones, activity-based forecasts fail to capture true deal progress and are likely to result in over forecasting.

3. Lack of Data Makes You Blind in your Sales Forecast

Forecasting basically is supposed to reflect the probability of winning a deal. However, sales forecasting without clear KPIs and reliable data on sales productivity is wishful thinking, not a solid strategy. Metrics like win ratio, pipeline creation, pipeline quality, and average deal size are essential for accurate forecasts.

Without consistent measurement and tracking of these metrics over time, the process becomes blind guesswork. Forecasts rely on trends and historical insights; without them, it’s like navigating without a compass, leading to missed targets and wasted resources.

Accurate Sales Forecast in B2B Tech / B2B SaaS in 3 Steps

To improve sales forecasting in B2B Tech / B2B SaaS, organizations must adopt a structured data driven process grounded in objectivity. Here are the three foundational pillars:

Step 1. Map Forecasting to the Customer Decision Process

Forecasting should not be a standalone activity. It must be integrated with your sales qualification process to align internal progress with the customer’s buying journey. Whether you use frameworks like MEDDICC, BANT, or others, your forecast should reflect the rigor of deal qualification.

Tie your sales forecasting to clear customer decision milestones such as:

- Has the budget been validated by the economic buyer, or is it still under review?

- Has the customer shortlisted vendors, or is the customer still in the discovery phase?

- Have you received a clear buy-in from the economic buyer about your competitive advantage over competitors?

By tying forecasts to external indicators, sales teams can better evaluate their ability to generate revenue with the current pipeline and significantly improve forecast accuracy (Struggling to define your sales qualification process? Have a look at our Process2Commit © masterclass).

Step 2. Account for Intra-Quarter Closing

Forecasting isn’t just about the pipeline at the start of the quarter. If you have a strong SMB business with a short sales cycle (around 60 days) or robust upsell opportunities in your customer base, many deals can materialize mid-quarter. Failing to account for these will lead to underestimations of revenue potential. Conversely, relying too heavily on early-stage deals can inflate projections unrealistically.

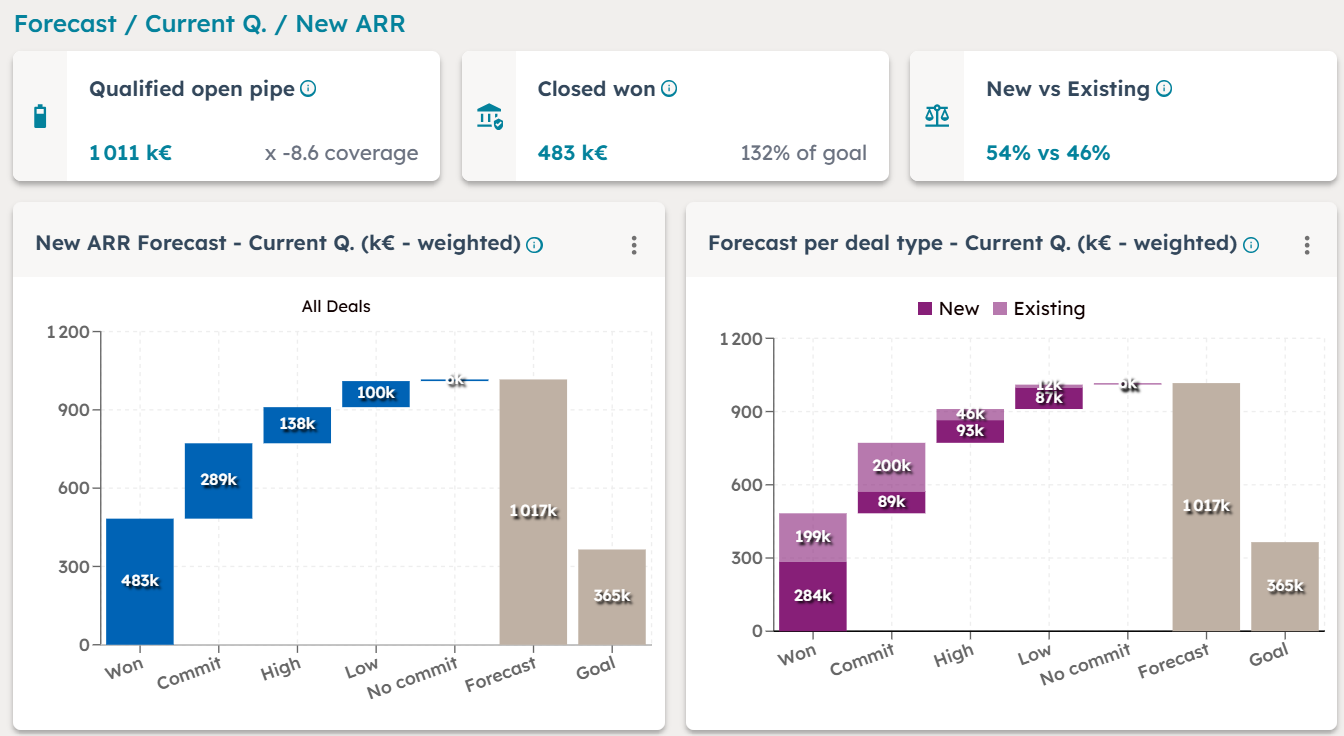

To properly account for intra-quarter closing, track these metrics weekly for segments with shorter sales cycles:

- Pipeline Creation: How much pipeline is generated during the quarter? How qualified is this pipeline?

- Time to Closing: How quickly are new opportunities progressing through the pipeline compared to historical benchmarks?

- Win Ratio: How does your current quarter’s win ratio align with past performance?

Accurately measuring these metrics will help you better evaluate intra-quarter contributions and refine forecasting by the end of the quarter (Struggling to track intra quarter bookings and other KPIs? Have a look at our Sales Performance Management Platform).

Step 3. Compare Forecasts with Actuals

A crucial element of robust sales forecasting is closing the loop to refine methods and address misaligned assumptions. This involves comparing forecasts made throughout the quarter to actual outcomes at the end.

Key activities include:

- Snapshot Analysis: Take weekly snapshots of your forecast to track its evolution. Identify patterns in pipeline movement and deal progression.

- Big Deals Impact: Large swing deals can drastically change a quarter’s outlook. Ensure these follow the same rules as other deals and specifically track any manual exceptions.

- Iterative Improvements: Use insights from snapshot analysis to adjust processes, criteria, and weights. For example, significant pipeline drops at the start of a quarter often signal that the pipeline wasn’t sufficiently cleaned before the quarter began.

Closing the loop not only enhances forecast accuracy but also fosters accountability and data-driven decision-making (Struggling to compare initial forecast vs final booking? Have a look at our Sales Performance Management Platform).

Conclusion: Writing Your Sales Forecasting Playbook

The backbone of reliable B2B Tech / B2B SaaS sales forecasting is a playbook—a documented guide that standardizes processes and enforces consistency across the sales organization (Struggling to produce your sales forecasting playbook? Have a look at our Forecast2Commit © masterclass). Here’s how to build one:

- Set Clear Deal Definitions

Standardize language and metrics to minimize personal interpretation. For example, a “Commit” deal should have the same definition across teams, geographies, and product types. Use rules that apply consistently across the pipeline, avoiding case-specific exceptions that create subjectivity. - Set Rules for CRM Data Capture

Your CRM must remain your single source of truth to automate forecast production. Configure it to align with your standardized definitions and sales forecasting framework. Ensure all sales reps input data consistently. - Communicate and Refine

Train sales teams on the sales forecasting playbook. Reinforce the importance of accurate data entry and show how improved forecasts benefit the organization. Track inconsistencies and refine the playbook as needed to address gaps or grey areas.

Forecasting isn’t just about producing a number. To move beyond subjective, activity-based methods, B2B tech / B2B SaaS companies need a process rooted in qualification, customer alignment, and real-time pipeline metrics. By adopting a rigorous playbook and committing to continuous improvement, organizations will achieve greater sales forecasting accuracy and predictability.

To continue exploring sales forecasting methodology, you can also read our article New Quarter in B2B Tech / B2B SaaS? 5 KPIs for Accurate Sales Forecast Beginning of Quarter. Interested in forecasting churn? Read our article Implement churn forecasting in B2B Tech / B2B SaaS and Plan for Net New ARR.

Agree or disagree with this article? Share your best practices!